Figure 1: The imaginary portrait of Ibn Khaldun in a Tunisian 10 Dinar banknote.

1. Introduction

Ibn Khaldun’s theory of taxation has been considered an original and one of his most important contributions to economic thought. It is his theory of taxation that has cemented his position in the history of economics. The present paper has a limited scope. It aims at an analytical study of this theory. It is only one aspect of Ibn Khaldun’s host of economic ideas. It also attempts to present empirical evidence that may support and strengthen his theory of taxation. Finally the paper examines its practicality and relevance today. But at the outset, as a background knowledge, it briefly presents Ibn Khaldun’s life sketch, introduces his most outstanding work the Muqaddimah and the economic ideas found in this work. Since Ibn Khaldun’s discussion of taxation is mixed with his discussion of expenditures of government at various stages, and they provide justification for taxation, this aspect has also been dealt with before taxation.

Ibn Khaldun does not discuss public finance in conventional way. This he leaves for works dealing with the government rules (al-ahkam al-sultaniyah). His focus of attention is taxation. He relates it with the government expenditure. Ibn Khaldun argued for low tax rate so that incentive to work is not killed and taxes are paid happily. According to him, when government is honest and people-friendly, as it happens to be at the beginning of a dynasty, “taxation yields a large revenue from small assessment. At the end of a dynasty, taxation yields a small revenue from large assessment”. The effect of taxation on incentives and productivity is so clearly visualized by Ibn Khaldun that he seems to have grasped the concept of optimum taxation. He also analyzed the effect of government expenditure on the economy. He advocates a policy of wise and productive public expenditure. He has rightly been considered as the forerunner of the famous American economist Arthur Laffer, whose proposition adds that high tax rates shrink the tax base because they reduce the economic activity. Ibn Khaldun’s ideas are ‘comparable with those of supply-side economics that emphasized incentives and tax cuts as a means of economic growth. This was the dominant theme during the 1980s. Thus, Ibn Khaldun’s ideas on taxation and government expenditure bear empirical evidence and have great relevance today.

2. Life sketch

Figure 2: View of Tunis where Ibn Khaldun was born in 1332 in Civitates orbis terrarum, the world atlas of cities edited by the German geographer Georg Braun (1541-1622) (vol. 2 published in 1574). The atlas contains 546 prospects and maps of cities from all around the world. The image of Tunis is a bird’s eye view looking down from the north, with the city, its waterways and fortifications clearly laid out below. The image shows the siege of Tunis by the Turks in 1574., which ended with the Spanish forced out of Tunis, which then became a Turkish regency. (Source).

Abu Zayd Abd al-Rahman Ibn Khaldun (732-808/1332-1406), historian, statesman and social philosopher was born in Tunis where he was well brought up and received the best education, both religious and secular. He died in Egypt where he had settled down during the last years of his life. He was a descendant of a well to do Andalusian family that left Spain before its fall to Christians. His ancestry according to him originated from Hadramut, Yemen.

Ibn Khaldun lived during a period of turmoil and stagnation. To him it was not a ‘habitual or normal’ situation, but as a phase of decline interrupted by vain attempts of revival. He studied this period of ossification punctured by intermittent crises (Lacoste 1984, p. 5). Rulers lost spirit of the religion, stability was replaced by anarchy; luxurious style of life did away with the simple living, and to stay in power with all these symbols of decadence, excessive taxation was imposed which acted as a powerful disincentive for undertaking economic activities. Arbitrary appropriation of people’s property by the government resulted in slackening in enterprises. Trading houses owned by rulers weakened the competitive spirit of commoners.

Ibn Khaldun played a pivotal role in the politics of North Africa and Spain. He saw rise and fall of various governments, and enjoyed company of a number of rulers. He served them in various capacities – teacher, advisor, minister, ambassador, and judge. His turbulent career as a court official and statesman successively in the service of various rulers in North-Africa and Spain, in courts, in prison and sometimes in Bedouin encampments, his ambassadorial mission to Pedro the cruel, the King of Castile, his emigration in 1382 to Egypt where he held high judiciary and teaching positions during several periods and was out of official grace during others, his loss of family, friends and assets, his meeting with Tamerlane as an ambassador of Egyptian ruler, all these ups and downs enriched him with great experience in his life that helped him write his famous history and the most famous Muqaddimah – an introduction to his history. In the opinion of Spengler (1964, p. 304), “Ibn Khaldun must have acquired much of his quite solid understanding of economic behavior through his legal and administrative experience and through his contact with the pool of unwritten administrative knowledge.” The French scholar Lacoste (1984, p.194) considers him “like a jewel in the midst of medieval Muslim culture.”

3. The Muqaddima

Figure 3: Two pages from the reprint in 3 volumes of the Paris 1858 edition of the Muqaddimah by the French Orientalist Etienne-Marc Quatreme`re: Muqaddimat Ibn Khaldūn wa-hiya al-juz’ al-awwal min Kitāb al-‘Ibar wa-dīwān al-mubtadā’ wa-al-khabar [The Muqaddimah of Ibn Khaldūn which is volume one of the his World history], bi-tahqīq A. M. Kātirmīr (Beirut: Maktabat Lubnān, 1992). (Source).

Ibn Khaldun has been ‘duly recognized by non-arabists as well as by arabists as one of the truly great and original scholars’ (Rabi’ 1967, p. 4). His work Kitab al-‘Ibar is of unrivalled value as a source of reference to the history of Arab and non-Arab nations until his time. His brilliant work ‘Al-Muqaddimah‘, conceived of as a theoretical introduction to his long book of history Al-‘ibar, considered the most sublime and intellectual achievement of the Middle Ages, is a treasury of many sciences like history, psychology, sociology, geography, economics, political sciences, etc. It is, in the words of one eminent 20th century historian, “the greatest work of its kind that has ever been created by any mind in any time or place.” (Toynbee 1935, p.322).

Ibn Khaldun was an eye witness to historical events. In many cases, he himself instigated historical events and altered their course. According to Charles Issawi (1950, p. ix), “the practical knowledge he gained in his political career led [Ibn] Khaldun to devise a path-breaking theory of history, in which the rise and fall of political dynasties depend on laws of social and economic change.” The prime object of Ibn Khaldun’s enquiries is a concrete social organization, a structured whole whose major determinants are the economy, politics and culture.

In addition to his personal experiences and insights, Ibn Khaldun also benefited from the cultural and intellectual inheritance of past scholars. “Ibn Khaldun, while profiting from their [other Muslim thinkers’] philosophical speculations, greatly surpassed them in his understanding of economic in nature, is rather loosely stated, in part because it was inferred from what had supposedly taken place in the five or six centuries preceding his time.” (Spengler 1964, pp.289-90). In the opinion of Hitti, “Ibn Khaldun was the greatest historian and philosopher ever produced by Islam and one of the greatest of all time” (quoted in Lacoste 1984, p. 1.) To Marçais, “the work of Ibn Khaldun is one of the most substantial and interesting book ever written” (ibid). To Gibb (1962), “the true originality of Ibn Khaldun’s work is to be found in his detailed and objective analysis of the political social, and economic factors underlying the establishment of political units and the evolution of the State, and it is the results of this detailed analysis that constitute the ‘new science’ which he claims to have founded.”

4. Economics of Ibn Khaldun

Figure 4: An annotated and collated edition of the Muqaaddimah by the Egyptian scholar ‘Alī ‘Abd al-Wāhid Wāfī: Muqaddimat Ibn Khaldūn, mahhada la-hā wa-nashara al-fusūl wa-al-faqarāt al-nāqisah min tab’ātihā wa-haqqaqahā wa-dabata kalimātihā wa-sharahahā wa-‘allaqa ‘alayhā wa-‘amala fahārisahā ‘Alī ‘Abd al-Wāhid Wāfī. (Cairo, Lajnat al-Bayān al-‘Arabī, 1957-1962, in 4 vols., 1370 pp.)

Figure 4: An annotated and collated edition of the Muqaaddimah by the Egyptian scholar ‘Alī ‘Abd al-Wāhid Wāfī: Muqaddimat Ibn Khaldūn, mahhada la-hā wa-nashara al-fusūl wa-al-faqarāt al-nāqisah min tab’ātihā wa-haqqaqahā wa-dabata kalimātihā wa-sharahahā wa-‘allaqa ‘alayhā wa-‘amala fahārisahā ‘Alī ‘Abd al-Wāhid Wāfī. (Cairo, Lajnat al-Bayān al-‘Arabī, 1957-1962, in 4 vols., 1370 pp.)With the development of modern Islamic economics in the 20th century, Ibn Khaldun’s economic ideas attracted the attention of scholars. The pioneer writings in this respect include names of Salih (1933), Rif’at (1937), Abdul-Qadir (1941), and Nash’at (1944) in the first half of the 20th century. The earliest and prominent writers on the economics of Ibn Khaldun in the second half of the century include Irving (1955), Sharif (1955) and the famous economic historian Joseph J. Spengler (1964). All these writers based their comments on the Muqaddimah. Ibn Khaldun’s economic ideas have attracted attention of researchers both from the East and the West. The Muqaddimah attracted increasingly scholarly attention and appreciation since its rediscovery in the West in the early 19th century (Rabi’ 1967, p.23).

Ibn Khaldun’s economic thinking covers topics like the theory of value, the price system, the law of demand and supply, division of labor, production, distribution and consumption of wealth, money, capital formation and growth, domestic and international trade, population, public finance, taxation and government expenditure, conditions for the progress of agriculture, industry and trade, slums and trade cycles, and the economic responsibilities of the ruler. He also hinted at some of ‘the macro-economic relations stressed by lord Keynes’ (Spengler 1964, p.304), and his cycle theory of civilization is “a model reminiscent of J. R. Hicks’s” (ibid, p. 293n).

According to Siddiqi (1992, p. 49), “a distinctive feature of Ibn Khaldun’s approach to economic problems, noted by several writers, is his keenness to take into consideration the various geographical, ethnic, political and sociological forces involved in the situation. He does not confine himself to the so-called economic factors alone.” Issawi (1950, p. 16) considers that “more clearly than many modern economists he saw the interrelation of political, social, economic and demographic factors.” As we noted somewhere else, the most appropriate description of his inquiry is ‘Economic Sociology’ (Islahi 1988, p. 246). In the light of his experiences, Ibn Khaldun first proposes a theory then supports it with evidence. Thus, his economics is based on empirical study. Boulakia (1971, p. 1105) admits that Ibn Khaldun “found a large number of economic mechanisms which were rediscovered by modern economists.” He writes also: “Like most of the authors of the fourteenth century, Ibn Khaldun mixes philosophical, sociological, ethical, and economical considerations in his writings. From time to time, a poem enlightens the text. However, Ibn Khaldun is remarkably well organized and always follows an extremely logical pattern” (ibid, p. 1106).

According to Lacoste (1984, p. 154), “Ibn Khaldun believes that there is close connection between the organization of production, social structure, forms of political life, juridical systems, social psychology and ideologies.” To Boulakia (1971, p. 1117), “Ibn Khaldun discovered a great number of fundamental economic notions a few centuries before their official births. He discovered the virtues and the necessity of a division of labor before Smith and the principle of labor value before Ricardo. He elaborated a theory of population before Malthus and insisted on the role of the state on the economy before Keynes. The economists who discovered mechanisms that he had already found are too many to be named (…) But, much more than that, Ibn Khaldun used these concepts to build a coherent dynamic system in which economic mechanisms inexorably lead economic activity to long-term fluctuations. Because of the coherence of his system, the criticisms which can be formulated against most economic constructions using the same notions do not apply here.” Spengler (1964, p. 268) considers him as the “medieval Islam’s greatest economist.” The fact that at present, from among the past Muslim scholars, maximum number of works are available on Ibn Khaldun’s economic thought has heightened, not lessened, the curiosity and further investigation about his contribution to the economy and the society.

Issawi (1950, p. 2) summarizes the special value of Ibn Khaldun’s contribution by asserting: “Indeed, it is not too much to say that Ibn Khaldun is the greatest figure in the social sciences between the time of Aristotle and that of Machiavelli, and as such deserves the attention of everyone who is interested in these sciences. More than anyone of his contemporaries, whether European or Arab, he tackles the kind of problem which preoccupies us today.”

5. Justification for taxes

Figure 5: A study in Japanese about Ibn Khaldūn’s sociological theories: Ibun Harudūn no “Rekishi josetsu” [Ibn Khaldūn’s Introduction to his World history] by Tamura Jitsuzo¯ hen (Tokyo: Ajia Keizai Kenkyūjo, 1964-65). (Source).

According to Ibn Khaldun “man is ‘political’ by nature” (Ibn Khaldun 1958, vol. 1, p. 89) [1]. This requires a government and a ruler to look after people’s affairs and control them. “Anarchy destroys mankind and ruins civilization, since the existence of royal authority is a natural quality of man. It alone guarantees their existence and social organization” (I: 304).

To perform its responsibilities towards the citizens and the economy, every state needs resources which have to be raised by the government through different means, the most important being the taxes, which is the focus of Ibn Khaldun in his Muqaddimah. He stresses that finance is vitally important to run a government. And to manage the revenue and expenditure, “the ministry of taxation is necessary to the royal authority” (II: 19). “It should be known that the office (of the tax collections) originates in dynasties only when their power and superiority and their interest in the different aspects of royal authority and in the ways of efficient administration have become firmly established” (II: 20-21). Ibn Khaldun is in favour of prudent and balanced budget. “Income and expenditure balance each other in every city. If the income is large, the expenditure is large and vice versa. And if both income and expenditure are large, the inhabitants become more favorably situated and the city grows” (II: 275).

6. The tax as the main component of public finance

Figure 6: Frontispice of Al-Nazarīyāt al-iqtisādīyah ‘inda Ibn Khaldūn wa-ususuhā min al-fikr al-Islāmī wa-al-wāqi’ al-mujtama’ī: dirāsah falsafīyah wa-ijtimā’īyah [The economic theories of Ibn Khaldūn and its foundations in Islamic thought and in actual societal reality: a philosophical and sociological study] by ‘Abd al-Majīd Mizyān (Algiers: al-Mu’assasah al-Watanīyah li-‘l-Kitāb, 1988).

Figure 6: Frontispice of Al-Nazarīyāt al-iqtisādīyah ‘inda Ibn Khaldūn wa-ususuhā min al-fikr al-Islāmī wa-al-wāqi’ al-mujtama’ī: dirāsah falsafīyah wa-ijtimā’īyah [The economic theories of Ibn Khaldūn and its foundations in Islamic thought and in actual societal reality: a philosophical and sociological study] by ‘Abd al-Majīd Mizyān (Algiers: al-Mu’assasah al-Watanīyah li-‘l-Kitāb, 1988).Ibn Khaldun does not study public finance as such. He leaves detailed account of public finance to works dealing with government administration (al-ahkam al-sultaniyah) (II: 23). Having briefly demonstrated the importance of finance in the life of the state, he discusses the financial problems that the government has to resolve as the state develops and relates them to other evolutionary factors. Ibn Khaldun distinguishes the rise and fall of a dynasty (i.e., state) into five stages: 1) conquest and success, 2) stability and self exalting, 3) economic expansion and enjoyment of the fruits of development, 4) contentment and compromise, and 5) extravagance, wastage and decadence. At each stage, the tax structures and government spending play a vital role. A summarized account of these stages is given below.

Supported and strengthened by group feeling and social cohesion, a new dynasty comes into being by over throwing all opposition. This is the first stage. “In this stage, the ruler serves model to his people by the manner in which he acquires glory, collects taxes, defends property and provides military protection” (I: 353). At another occasion he says: “at the beginning, the dynasty has a desert attitude… It has the qualities of kindness to subjects, planned moderation in expenditures, and respect of other people’s property. It avoids onerous taxation and the display of cunning or shrewdness in the collection of money and the accounting (required) from officials. Nothing at this stage calls for extravagant expenditure. Therefore the dynasty does not need much money” (II: 122).

In the second stage, “the ruler gains complete control over his people, claims royal authority all for himself excluding them and prevents them from trying to have a share in it” (ibid). Thus it is a stage of stabilization and consolidation of forces, strengthening further the group feeling and rewarding his supporters through benevolent expenditure.

The third stage is a stage of economic prosperity and enjoyment of the “fruits of royal authority.” Increasing attention is paid to collection of taxes, administration of public revenue and expenditure. Development of cities, construction of large buildings, increase in allowances of officials and general public attract the attention. The burden of luxurious expenditure and taxation increases even though tranquillity and contentment prevail. “This stage is the last during which the ruler is in complete authority. Throughout this and the previous stages, the rulers are independent in their opinion. They build up their strength and show the way for those after them” (I: 354-55).

In the fourth stage, “the ruler is content with what his predecessors have built: He limits his activities, follows closely in their footsteps” (ibid). He takes no initiative by himself. Expansion in politico–economic power stops and some sort of stagnation starts.

In the fifth stage, the ruler indulges in extravagance, lives an extra-luxurious life, wastes the resources accumulated by previous rulers. Incompetent and unqualified followers are entrusted the most important matters of the state. Idle court men are rewarded, and sincere critics are humiliated and punished. The ruler loses all kind of sympathy and group feeling. In this stage taxes increase, while revenue declines. The economy is shattered and social system is disturbed. The government suffers from incurable disease, which leads to its downfall and takeover by a new dynasty, supported by strong group feeling and social-cohesion.

Ibn Khaldun’s emphasis was on how a society’s living standards could be affected, either for better or worse, by state policies. He was especially interested in how a greedy ruler might impose such a high tax rate that economic activity would be stifled and tax revenues ultimately reduced. Taxes and government expenditures determine the strength or weakness of the dynasty at various stages in its development. That is the reason why Ibn Khaldun pays much attention to the analysis of taxes. This being one of the most important contributions to economic thought that bear great relevance today. But writers on economics of Ibn Khaldun have not fully discussed his theory of taxation. Perhaps because of their preoccupation to cover every aspect of his economic thought. In view of this fact, the present paper aims to focus mainly on his theory of taxation and its relevance in the contemporary world.

7. Importance of taxes comes from the importance of government expenditures

Ibn Khaldun has analyzed the effect of government expenditure on the economy in much details. In this respect, he may be considered, in the opinion of Chapra (2000, p. 164), as “a forerunner of Keynes.” He is aware that the government expenditure is a major source of the development of the economy. It helps in growth of national income. Sufficient revenue is necessary for the government to do the things that are needed to support the population and to ensure law and order and political stability.

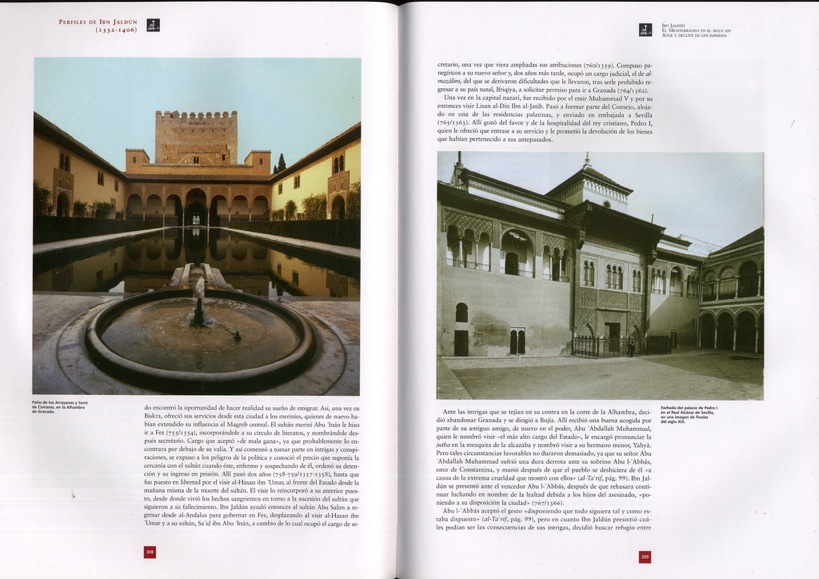

Figure 7a-b: The front cover and two pages from the catalogue of an exhibition held in the Real Alcázar de Sevilla in May-September 2006: Ibn Jaldu´n: el Mediterráneo en el siglo XIV. Auge y declive de los imperios [Ibn Khaldūn: The Mediterranean [Region in the XIV century. The rise and fall of empires] (Sevilla: Fundacio´n El Legado Andalusi´ and Fundacio´n Jose´ Manuel Lara, 2006).

He stresses that “curtailment of the allowances given by the ruler implies curtailment of the tax revenue”. He explains:

“The reason for this is that dynasty and government serve as the world’s greatest market place, providing the substance of civilization. Now, if the ruler holds on to property and revenue, or they are lost or not properly used by him, then the property in the possession of the ruler’s entourage will be small. The gifts which they, in their turn, had been used to give to their entourage and people, stop, and all their expenditures are cut down. They constitute the greatest number of people (who make expenditures), and their expenditure provides more of substance of trade than (the expenditure of) any other (group of people). Thus (when they stop spending), business slumps and commercial profits decline because of the shortage of capital. Revenues from the land tax decrease, because the land tax and taxation (in general) depend on cultural activity, commercial transactions, business prosperity, and the people’s demand for gain and profit. It is the dynasty that suffers from the situation and that has a deficit, because under these circumstances the property of the ruler decreases in consequence of the decrease in revenues from the land tax” (II:102-103).

A decrease in government spending leads to not only a slackening of business activity and a decline in profits but also a decline in tax revenue. As he sated above, “the dynasty is the greatest market, the mother and base of all trade. (It is the market that provides) the substance of income and expenditure (for trade). If government business slumps and the volume of trade is small, the dependent markets will naturally show the same symptoms, and to a greater degree. Furthermore, money circulates between subjects and ruler, moving back and forth. Now if the ruler keeps it to himself, it is lost to the subjects” (II:103).

At another occasion Ibn Khaldun points out the multiplier effect of the government spending: “The tax money reverts to the (people). Their wealth, as a rule, comes from their business and commercial activities. If the ruler pours out gifts and money upon his people, it spreads among them and reverts to him and again from him to them. It comes from them through taxation and the land tax and reverts to them through gifts. The wealth of the subjects corresponds to the finances of the dynasty. The finances of the dynasty, in turn, correspond to the wealth and number of the subjects. The origin of it all is civilization and its extensiveness” (II:291).

8. A Government must avoid extravagance and extreme luxuries.

To Ibn Khaldun, non-rational government spending and extravagance may lead to disintegration of the state. The prodigality and the widening of the circle of those who are beneficiaries of the state lead to a revenue crisis resulting in illegitimate intervention in the economy by confiscation and the setting up of monopolies harmful to the general public, with the consequence that cultural activities diminish and the power group become narrower and the whole structure eventually breaks down, leading either to the dissolution of the government or to its revivification by the establishment of a new dynasty (i.e. state).

He develops this thesis in length as follows:

“Later comes domination and expansion. Royal authority flourishes. This calls for luxury. (Luxury) causes increased spending. (…) Extravagant expenditures mount… The ruler, then, must impose duties on articles sold in the markets in order to improve his revenues. Habits of luxury, then, further increase. The customs duties no longer pay for them. The dynasty, by this time, is flourishing in its power and its forceful hold over the subjects under its control. Its hands reach out to seize some of the property of the subjects, either through customs duties, or through commercial transactions, or in some cases merely by hostile acts directed against (property holdings), on some pretext or even with none. (…) At this stage, the soldiers have already grown bold against the dynasty, because it has become weak and senile. (…) At this stage, the tax collectors in the dynasty have acquired much wealth, because vast revenues are in their hands and their position has widened in importance for this reason. Suspicions of having appropriated tax money, therefore, attach to them” (II:123).

“After their prosperity is destroyed, the dynasty goes further a field and approaches its other wealthy subjects. The policy of the ruler, at this time, is to handle matters diplomatically by spending money. He considers this more advantageous than the sword, which is of little use. (…) At each of these stages, the strength of the dynasty crumbles. Eventually, it reaches complete ruin. It is open to domination by any aggressor” (II:124).

He further says: “The first element of disintegration afflicts the dynasty, that which comes through the soldiers and militia… This is paralleled by extravagance in expenditure” (II:125). “At this time, the income of the dynasty is too small to pay for the expenditures, thus the second element of disintegration afflicts the dynasty, that which comes through money and taxation” (II:126). Ibn Khaldun quotes from a letter written by Tahir Ibn al-Husayn, Caliph al-Ma’mun’s general, advising his son, ‘Abdullah Ibn Tahir: “Be moderate in every thing. There is nothing more clearly useful, safer, and in every way better, than (moderation)…” (II:142). “Give your subjects their share. Pay attention to the things that might improve their situation and livelihood. If you do that, the (divine) favour will always be with you. You will make it obligatory for God to increase (his favors to you). In this way, you will also be better to levy the land tax and to collect the property of your subjects and your provinces. Because everybody experiences justice and kindness from you, everybody will be more amenable to obeying you and more favourably disposed toward everything you want…” (II:146).

Ibn Khaldun emphasizes on productive and necessary expenditure. Luxurious and non-necessary expenditure should be avoided. Especially when they are at the cost of people’s property and prosperity. He wrote: “Then gradual increases in the amount of assessments succeed each other regularly, in correspondence with the gradual increase in the luxury customs and many needs of the dynasty and spending required in connection with them. Eventually, the taxes will weigh heavily upon the subjects and overburden them…” (II: 89-90). “It should be known that in the beginning, dynasties maintain the Bedouin attitude… Therefore, they have few needs, such luxury and the habits that go with it do not (yet) exist. Expenses and expenditures are small. At that time, revenue from taxes pays for much more than the necessary expenditures, and there is a large surplus.” (II:91).

Thus, for a simple economy that concentrates on provision of basic infrastructures and need fulfilment of people would not face shortage of pecuniary resources. Most likely, its budget will be surplus. Problems arise when it enters the sphere of luxury, and in seeking luxuries it ignores the interest of commoners. Ibn Khaldun’s following statement is self evident:

“The dynasty, then, soon starts to adopt the luxury and luxury customs of sedentary culture, and follows the course that had been taken by previous dynasties. The result is that the expenses of the people of the dynasty grow. Especially do the expenses of the ruler mount excessively, on account of his expenditure for his entourage and the great number of allowances he has to grant. The (available) revenue from taxes cannot pay for all that. Therefore, the dynasty must increase its revenues, because the militia needs (ever) larger allowances and the ruler needs (ever) more money to meet his expenditures. At first, the amounts of individual imposts and assessments are increased, as we have stated. Then, as expenses and needs increase under the influence of the gradual growth of luxury customs and additional allowances for the militia, the dynasty is affected by senility. Its people are too weak to collect the taxes from the provinces and remote areas. Thus, the revenue from taxes decreases, while the habits (require money) increase. As they increase, salaries and allowances to the soldiers also increase. Therefore, the ruler must invent new kinds of taxes. He levies them on commerce. He imposes taxes of a certain amount on prices realized in the markets and on the various (imported) goods at the city gates. (The ruler) is, after all, forced to this because people have become spoiled by generous allowances, and because of the growing numbers of soldiers and militiamen. In the later (years) of the dynasty, (taxation) may become excessive. Business falls off, because all hopes (of profit) are destroyed, permitting the dissolution of civilization and reflecting upon (the status of) the dynasty. This (situation) becomes more and more aggravated, until (the dynasty) disintegrates” (II:91-92). Thus the government in its last stage is caught in a vicious circle of increasing rates and diminishing revenue, as explained in one of the sections below.

At this stage, demand for more money comes not only from the ruler but also from his military, officials and court men. In addition to oppressive rate, tax bases are widened ignoring all principles of taxation. Corrupt tax collectors aggravate the situation further. “A dynasty may find itself in financial straits…, on account of its luxury and the number of (its luxurious) habits and on account of its expenditures and the insufficiency of the tax revenue to pay for its need and expenditures. It may need more money and higher revenues. Then, it sometimes imposes custom duties on the commercial activities of (its) subjects… Sometimes, it increases the kind of custom duties, if (custom duties as such) had been introduced before. Sometimes, it applies torture to its officials and tax collectors and sucks their bones dry (of a part of their fortune). (This happens) when officials and tax collectors are observed to have appropriated a good deal of tax money, which their accounts do not show”. (II:93) A life full of luxuries and allocation of major portion of government revenue to those luxuries is a symptom of decadence. ‘When the natural (tendency) of the royal authority to claim all glory for itself and to obtain luxury and tranquillity have been firmly established, the dynasty approaches senility” (I:339).

At the final stage of glory, luxury and tranquillity, “people get accustomed to a greater number of things. Their expenses are higher than their allowances and their income is not sufficient to pay for their expenditures. Those who are poor perish. Spendthrifts squander their incomes on luxuries. This (condition) becomes aggravated in the later generations. Eventually, all their income cannot pay for the luxuries and other things they have become used to. They grow needy” (I:340). “Also when luxury increases in a dynasty and people’s income become insufficient for their need and expenses, the ruler must increase their allowances. (…) Tax income being fixed, new custom duties are imposed. (…) Luxury, meanwhile, still on the increase.” (…) “Luxury corrupts the character… The dynasty shows symptoms of dissolution and disintegration. It becomes affected by the chronic disease of senility and finally dies” (I:340-41).

9. His theory of taxation

The core of Ibn Khaldun’s theory of taxation, in his own words, is: “to lower as much as possible the amounts of individual imposts levied upon persons capable of undertaking cultural enterprises. In this manner, such persons will be psychologically disposed to undertake them, because they can be confident of making a profit from them” (II: 91).

Thus, he advocates for decreasing the burden of taxation on businessmen and producers, in order to encourage enterprise by ensuring greater profits to entrepreneur and revenue to the government. In practice, he found that at the initial stage, the government relies on low taxes , in keeping with Islamic law. As a result, enterprises increase in number and size and thus permit tax base, tax revenue, and governmental surplus to grow.

He says: “At the beginning of a dynasty, taxation yields a large revenue from small assessment. At the end of a dynasty, taxation yields a small revenue from large assessment. The reason for this is that when the dynasty follows the way (sunan) of the religion, it imposes only such taxes as are stipulated by the religious law, such as charity taxes, the land tax, and the poll tax. They mean small assessments, because, as every one knows the charity tax on property is low. The same applies on charity tax on grain and cattle, and also to the poll tax, the land tax and all other taxes required by the religious law. They have fixed limits that cannot be overstepped” (II: 89).

He describes the advantages of low taxes: “When the tax assessments and imposts upon the subjects are low, the latter have energy and desire to do things. Cultural enterprises grow and increase, because the low taxes bring satisfaction. When the cultural enterprises grow, the number of individual imposts and assessments mounts. In consequence, the tax revenue, which is the sum total (of the individual assessments), increases” (II: 89-90). In the course of time, however, royal expenditure increases, with the result that private expenditure, especially upon non-necessities, also increases and intensifies the money cost of manpower and other objects of royal expenditure. It then becomes necessary for the government, if it has to continue expenditure at a high and rising rate, to increase assessments and tax rates and to levy more and higher customs duties.

“Customs duties are placed upon articles of commerce, and levied at the city gates. Then gradual increases in the amount of assessments succeed each other regularly, in correspondence with the gradual increase in the luxury customs and many needs of the dynasty and spending required in connection with them. Eventually, the taxes will weigh heavily upon the subjects and overburden them…” (II:90). Taxation begins to eat so heavily into business profit that business enterprise is discouraged, finally diminishing in amount with the result that tax revenue declines.

“Therefore, many of them refrain all cultural activity. The result is that total tax revenue goes down, as (the number of) the individual assessments go down. Often, when the decrease is noticed, the amounts of individual imposts are increased. This is considered a means of compensating for the decrease. Finally, individual imposts and assessments reach their limit. It would be of no avail to increase them further. The costs of all cultural enterprise are now too high, the taxes are too heavy, and the profits anticipated fail to materialize. Thus, the total revenue continues to decrease, while the amounts of individual imposts and assessments continue to increase, because it is believed that such an increase will compensate (for the drop in revenue) in the end. Finally, civilization is destroyed, because the incentive for cultural activities is gone. It is the dynasty that suffers from the situation, because it (is the dynasty that) profits from cultural activity” (II: 90-91).

In this way the government is caught in a vicious circle of financial crisis. Enough money is not forthcoming, and the dynasty, its money foundation being undermined, would presently find itself unable any longer to support its soldiery (i.e., its military foundation) to their satisfaction. Hence, its disintegration, already under way, would be accelerated.

The adverse effect is intensified when the now frustrated government, still bent upon continuing an insupportable rate of expenditure, not only increases taxes and tax rates but also engages in commercial enterprise and undertakes “to buy monopsonistically and sell monopolistically” [2], with the result that business activity is discouraged and tax revenue shrinks further. Many passages of the Muqaddimah deal with several aspects o this analysis:

“An injustice even greater and more destructive of civilization and the dynasty is the appropriation of people’s property by buying their possessions as cheaply as possible and then reselling the merchandise to them at the highest possible prices by means of forced sales and purchases” (II:109).

“If no trading is being done in the markets, the subjects have no livelihood, and the tax revenue of the ruler decreases or deteriorates, since… most of the tax revenue comes from customs duties on commerce…” (II:110).

“It should be known that all these practices are caused by the need for money on the part of dynasty and ruler….The ordinary income does not meet the expenditures. Therefore, the ruler invents new sorts and kinds of taxes, in order to increase the revenues and to be able to balance the budget” (II:111).

“The need for appropriating people’s property becomes stronger and stronger. In this way, the authority of the dynasty shrinks until its influence is wiped out and its identity is lost and it is defeated by an attacker”. (II:92)

10. How oppressive duties cause a decline of revenue

Taxes enter many decisions, but the two most important are probably that they discourage work, since they lower the after-tax return from work, and they discourage saving and investment, since they lower after-tax returns. Ibn Khaldun wrote in this respect:

“The trouble and financial difficulties and the loss of profit which it causes the subjects, takes away from them all incentives to effort, thus ruining the fiscal (structure). Most of the revenue from taxes come from farmers and merchants, especially once custom duties have been introduced and the tax revenue has been augmented by means of them. Thus, when the farmer gives up agriculture and the merchant goes out of business, the revenue from taxes vanishes altogether or becomes dangerously low. Furthermore, (the trading of the ruler) may cause the destruction of civilization and, through the destruction and decrease of (civilization), the disintegration of the dynasty. When the subjects can no longer make their capital larger through agriculture and commerce, it will decrease and disappear as the result of expenditures. This will ruin their situation. This should be understood’. (II:95).

In another passage, he asserted: “If (the reader) understands this, he will realize that the strongest incentive for cultural activity to lower as much as possible the amounts of individual imposts levied upon persons capable of undertaking cultural enterprises. In this manner, such persons will be psychologically disposed to undertake them, because they can be confident of making a profit from them” (II: 91). According to Chapra (2000, p. 163), “the effect of taxation on incentives and productivity was so clearly visualized by Ibn Khaldun that he seems to have grasped the concept of optimum taxation.”

Ibn Khaldun also recognizes what is termed as ‘incidence of taxation’: “A city with a large civilization (population) is characterized by high prices for its needs. (The prices) are then raised still higher through customs duties” (II:292). “The customs duties raises the sales (prices), because small businessmen and merchants include all their expenses, even their personal requirements, in the price of their stock and merchandise. Thus, customs duties enter into the sales price” (II:293).

End Notes

[1] The Muqaddimah will be quoted in the English translation by Rosenthal as Ibn Khaldun 1958 followed by volume number in Roman and page number after colon. The author would like to admit that instead of using his own translation of the Arabic texts of the Muqaddimah, he preferred to use one by Rosenthal which is well known and much appreciated by the community of researchers.

11. Tax rate vs. tax revenue

Figure 8: Front cover of Ibn Khaldoun: Un génie maghrébin (1332-1406) by Smaïl Goumeziane (Paris: Editions Non Lieu, 2006).

It seems that Ibn Khaldun has fully perceived that tax rates and tax revenues are two distinct things. A high tax rate is no guarantee that it will maximize tax revenues. Rather, it will be showing a diminishing revenue after a certain stage. Because higher tax rates discourage work effort and encourage tax avoidance and even tax evasion, the tax base will shrink as the rates increase. Therefore, an increase in a tax rate causes a less than proportional increase in tax revenue. It is very obvious that at a tax rate of zero percent, the government would collect no tax revenues, no matter how large the tax base. Likewise, at a tax rate of hundred percent, the government would also collect no tax revenues because no one would willingly work for an after-tax gain of zero (i.e., there would be no tax base).

Between these two extremes there would be a tax rate that would collect the maximum amount of revenue. But a government in its initial stage does not require to opt for maximum-income rate because the life is simple and a lower than maximum income level is sufficient to meet the needs. Only at its full grown socio-economic and political structure the state would resort to higher rate for higher revenue. Ibn Khaldun himself states that expenditure was higher when the kingdoms were in their heyday than when they were in decline. Expenditure could then be covered without the state having to oppress and ransom the population: “The ruler and his entourage are wealthy only in the middle period of the dynasty” (II:97). As soon as it crosses that maximum income level, a kind of vicious circle starts. A still higher rate results a decline in revenue and a declining revenue induces to further increase the tax rate (cf. II: 91-92).

More revenue at moderate rate and less revenue at an excessive rate may also be explained in term of two different effects – the arithmetic effect and the economic effect – which the tax rates have on revenues. The two effects have opposite results on revenue in case the tax rates are increased or decreased. According to the arithmetic effect if tax rates are lowered, tax revenues will be lowered by the amount of the decrease in the rate. The reverse is true for an increase in tax rates. The economic effect, however, recognizes the positive impact that lower tax rates have on work, output, and employment – and thereby the tax base – by providing incentives to increase these activities whereas raising tax rates has the opposite economic effect by penalizing participation in the taxed activities. At very high tax rate negative economic effect dominates positive arithmetic effect, therefore, the tax revenue declines.

12. Principles of taxation

While presenting his ideas on taxation Ibn Khaldun emphasized various principles that must be observed to have a sound taxation policy, such as equity and efficiency, justice and neutrality, ability to pay, economy, benefit and convenience principles. In imposition of taxes justice and ability to pay must be observed. “Do not ask for more than is tolerable. Do not charge anyone too much. Treat all the people justly. This makes it easier to gain their friendship and it is more certain to achieve general satisfaction” (II:150).

He warns of the bad consequences of violation of equity, efficiency and benefit principles when he says: “The assessments increase beyond the limits of equity. The result is that the interest of the subjects in cultural enterprises disappears, since when they compare expenditures and taxes with their income and gain and see the little profit they make, they lose all hope. Therefore, many of them refrain from all cultural activity. The result is that total tax revenue goes down, as (the number of) the individual assessments goes down” (II: 90-91). The characteristics universally associated with a good tax system are fairness, simplicity, least interference with economic decisions as also certainty, stability and acceptability by the taxpayers. All these elements of a good tax system are implied in Ibn Khaldun’s statement. He also reminds of the bad consequences of injustice and discrimination in matter of taxation, discussed in the following section.

13. Consequences of injustice and discrimination in tax imposition

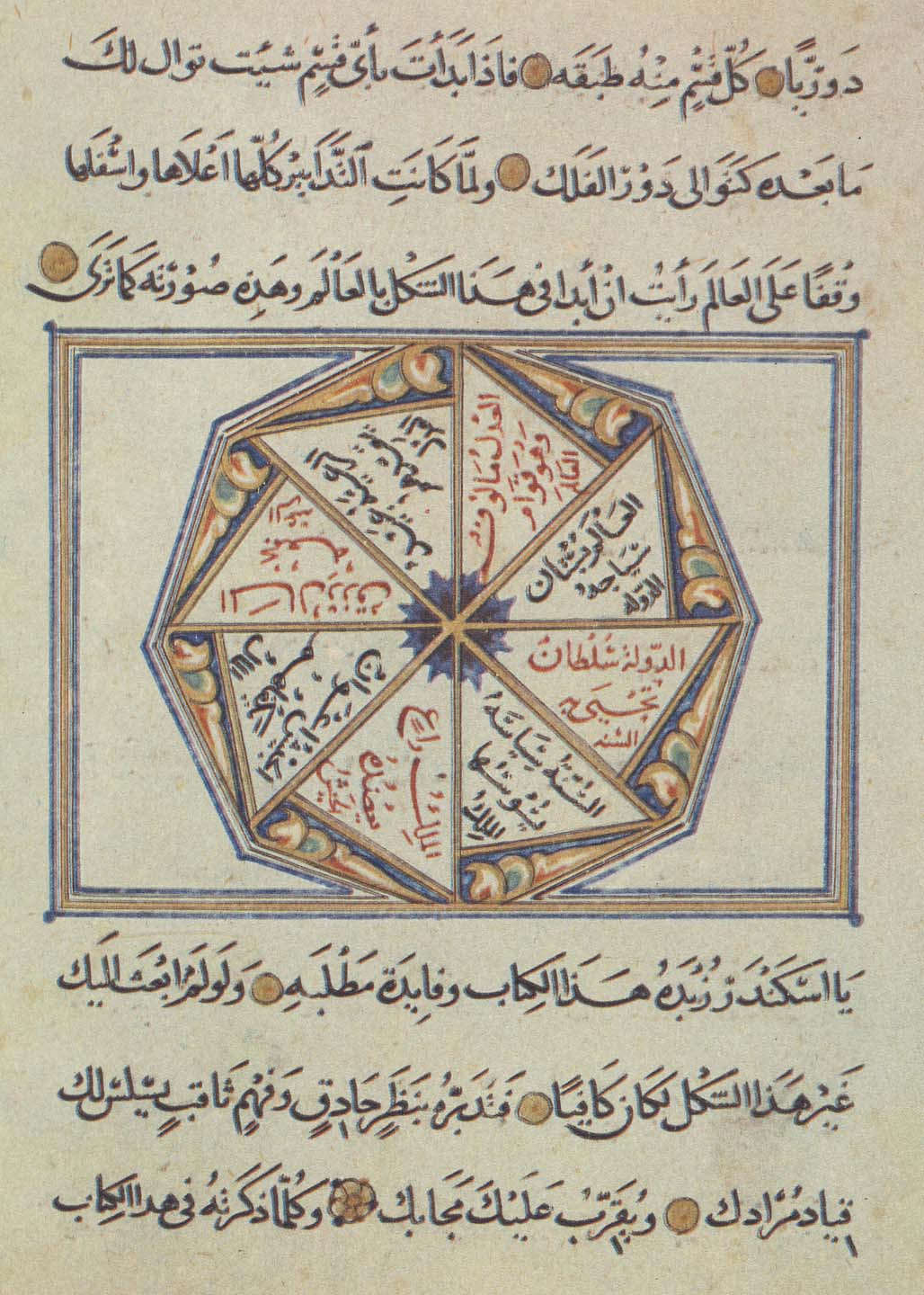

Figure 9: A page from an Arabic Ottoman manuscript from the Secretum Secretorum attributed to Aristotle (MS Reis el-Kuttap, Asir I, 1002.) The Secretum Secretorum (The Secret of Secrets) otherwise known as The Education of Princes was a popular medieval book. It first came to Latin from Arabic from Syriac translations of a supposed Greek original attributed to Aristotle. The Arabic text is attributed to Ikhwan al-Safa of Basra (10th Century) who report to have taken the bulk of it from the translation of Yahia ibn al-Batriq, a Christian from Syria. This book captured the attention of Ibn Khaldun who quotes and analyses it at length in his Muqaddimah. (Source).

Figure 9: A page from an Arabic Ottoman manuscript from the Secretum Secretorum attributed to Aristotle (MS Reis el-Kuttap, Asir I, 1002.) The Secretum Secretorum (The Secret of Secrets) otherwise known as The Education of Princes was a popular medieval book. It first came to Latin from Arabic from Syriac translations of a supposed Greek original attributed to Aristotle. The Arabic text is attributed to Ikhwan al-Safa of Basra (10th Century) who report to have taken the bulk of it from the translation of Yahia ibn al-Batriq, a Christian from Syria. This book captured the attention of Ibn Khaldun who quotes and analyses it at length in his Muqaddimah. (Source).In addition to excessive and oppressive rate of taxation, injustice and discrimination results in decline in tax revenue. Ibn Khaldun makes a detailed analysis of the extortion that characterised the north African states during the period of their decadence:

“Injustice brings about the ruin of civilization… Attacks on people’s property remove the incentive to acquire and gain property. People, then, become of the opinion that the purpose and ultimate destiny of acquiring property is to have it taken away from them. When the incentive to acquire and gain property is gone, people no longer make any efforts to acquire any. The extent and degree to which property rights are infringed upon determines the extent and degree to which the effort of the subjects to acquire property slackens” (II:103).

“The proven fact is that civilization inevitably suffers losses through injustice and hostile acts… and it is the dynasty that suffers there from. Injustice should not be understood to imply only the confiscation of money or other property from the owners without compensation and without cause… it is something more general than that. Whoever takes someone’s property, or uses him for forced labour, or presses an unjustified claim against him, or imposes upon him a duty not required by the religious law, does an injustice to that particular person. People who collect unjustified taxes commit an injustice. Those who infringe upon property rights commit an injustice. Those who, in general, take property by force by force commit an injustice. It is the dynasty that suffers from all these acts, in as much as civilization, which is the substance of the dynasty, is ruined when people have lost all incentive” (II:106-07).

“One of the greatest injustices and one which contributes most to the destruction of civilization is the unjustified imposition of tasks and the use of subjects for the forced labour” (II:108-109). In fact, justice is inevitable not only in tax policy. It is the basis of an entire system. “The religious law persists only through royal authority. Mighty royal authority is achieved only through men. Men persist only with the help of property. The only way to property is through cultivation. The only way to cultivation is through justice. Justice is a balance set up among mankind” (II:105).

From the preceding quotes, it is clear that Ibn Khaldun considers injustice as the most injurious and deleterious to the health of the government. It may be noted that the decline in the volume of trade forced the North African states, which required a relatively high budget if they were to function, to tax the population increasingly heavily. This proves that, prior to the period of ‘decadence’, a major proportion of the state budget must have derived from taxes on trading profits. The taxes permitted by Islamic Shari’ah were not enough to supply the states with the huge resources they needed if they were to last and if their apparatus were to function properly. These states never established a regular, efficient fiscal system. So they had to resort to illegal methods and to what Ibn Khaldun called ‘injustice’.

A very close form of injustice is discrimination. Ibn Khaldun is especially against any discrimination in imposition of taxes. “Do not make a noble man (sharif) pay less because of his nobility, or a rich man because of his wealth, or one of your secretaries, or one of your intimates and entourage” (II:150). The reason is clear: people may tolerate an unjust tax if levied justly on all tax payers. But they express resentment if some of them are exempted or lightly taxed.

14. Ibn Khaldun – a forerunner of supply-side economics

Ibn Khaldun’s ideas on tax cuts are “comparable with those of supply-side economics” (Baeck, 1994, p. 117) [3]. He has rightly been considered as the forerunner of Laffer’s curve [4], 600 years before Laffer (Lipsey and Steiner 1981, p. 449). Arthur Laffer himself, who popularized during the 1980s the notion that higher tax rates may actually cause the tax base to shrink so much that tax revenues will decline, gave the credit for invention of Laffer’s curve to Ibn Khaldun (Laffer, 2004) [5].

Laffer has honestly and earnestly admitted: “The Laffer Curve, by the way, was not invented by me. For example, Ibn Khaldun, a 14th century Muslim philosopher, wrote in his work The Muqaddimah: ‘It should be known that at the beginning of the dynasty, taxation yields a large revenue from small assessments. At the end of the dynasty, taxation yields a small revenue from large assessments'” (Laffer 2004).

14.1. Empirical evidences from the United States’ economy

Empirical studies of tax cuts that took place in USA during the twenties, sixties and eighties support Ibn Khaldun’s theory of taxation and show that it is still vital and well-suited if similar conditions are found. “Prodded by Secretary of the Treasury Andrew Mellon, three major tax cuts reduced the top marginal tax rate from 73 percent in 1921 to 25 percent in 1926. In addition, the tax cuts eliminated or virtually eliminated the personal income tax liability of low-income recipients. The results were quite impressive. The economy grew rapidly from 1921 through 1926. After the rates were lowered, the real tax revenue (in 1929 dollars) collected from taxpayers with incomes above $50,000 rose from $305.1 million in 1921 to $498.1 million in 1926, an increase of 63 percent” (Gwartney 2006).

The results of the Kennedy-Johnson tax cuts of the mid-sixties were similar. “Between 1963 and 1965, tax rates were reduced by approximately 25 percent. The top marginal tax rate was cut from 91 percent to 70 percent. Simultaneously, the bottom rate was reduced from 20 percent to 14 percent. For most taxpayers the lower rates reduced tax revenues. In real 1963 dollars the tax revenues collected from the bottom 95 percent of taxpayers fell from $31.0 billion in 1963 to $29.6 billion in 1965, a 4.5 percent reduction. In contrast, the real tax revenues collected from the top 5 percent of taxpayers rose from $17.2 billion in 1963 to $18.5 billion in 1965, a 7.6 percent increase. As in the case of the tax cuts of the twenties, the rate reductions of the sixties reduced the tax revenue collected from low-income taxpayers while increasing the revenues collected from high-income taxpayers” (ibid).

During the 1980s, the policy of tax cuts used by president Reagan is generally referred to Reagonomics. “Major tax legislation passed in 1981 and 1986 reduced the top U.S. federal income tax rate from 70 percent to approximately 33 percent. The performance of the U.S. economy during the eighties was impressive. The growth rate of real GNP accelerated from the sluggish rates of the seventies. U.S. economic growth exceeded that of all other major industrial nations except Japan” (Gwartney 2006).

In an article, Laffer (2004) has shown through data of “Before and After: Total Income Tax Revenue” during the years from 1978 to 1986 that in USA during the 1980s ‘across-the-board marginal tax-rate cuts resulted in higher incentives to work, produce, and invest, and the economy responded. Between 1978 and 1982, the economy grew at a 0.9 percent annual rate in real terms, but from 1983 to 1986 this annual growth rate increased to 4.8 percent. Prior to the tax cut, the economy was choking on high inflation, high interest rates, and high unemployment. All three of these economic bellwethers dropped sharply after the tax cuts’. Another proof comes from Gwartney in his article on “Supply-Side Economics”. He says: “Probably the most detailed study of the tax changes in the eighties was conducted by Lawrence Lindsey of Harvard University. Lindsey used a computer simulation model to estimate the impact of the eighties’ tax-rate changes on the various components of income. He found that after the tax rates were lowered, the wages and salaries of high-income taxpayers were approximately 30 percent larger than projected. Similarly, after the rate cuts capital gains were approximately 100 percent higher than projected, and high-income taxpayers’ business income was a whopping 200 percent higher than expected.”

It may be noted that the policy of tax cuts provided the political and theoretical foundation for a remarkable number of tax cuts in the United States and other countries during the eighties. “Of eighty-six countries with a personal income tax, fifty-five reduced their top marginal tax rate during the 1985-90 period, while only two (Luxembourg and Lebanon) increased their top rate. Countries that substantially reduced their top marginal tax rates include Australia, Brazil, France, Italy, Japan, New Zealand, Sweden, and the United Kingdom” (Gwartney, 2006).

Ibn Khaldun’s view of taxation offers a useful example of how an economic concept can be reapplied in an entirely different setting. As insightful as this view undoubtedly was for the times he lived in, one would think that it might not seem to be applicable to the modern age of democratic governments, because no elected government would ever raise tax rates beyond the point where tax revenues would fall. But the experiences of United States and many other countries show that it is viable even in a changing situation if the tax rates cross the optimum taxation limit. According to Laffer (2004), “the higher tax rates are, the greater will be the economic (supply-side) impact of a given percentage reduction in tax rates. Likewise, under a progressive tax structure, an equal across-the-board percentage reduction in tax rates should have its greatest impact in the highest tax bracket and its least impact in the lowest tax bracket.”

14.2. The Indian experience

The last two decades of the Indian experience also supports the soundness of Ibn Khaldun’s theory of taxation based on tax rates cut. Influenced by the propounders of the supply-side economists, the Indian authorities also brought a tax reform applying the tax rates cut policy and experienced good effects on tax revenue collection. That policy still continues in spite of political changes. Recently, Jude Wanniski authored an article entitled “India swings on the Laffer curve” in which he wrote: “One clear reason can be found in a headline in Bloomberg’s financial network on 11 January 2005, over a story by Andy Mukherjee writing from Singapore: “India’s Tax Plan May Again Bet on Laffer Curve.” I was most pleased to read that Finance Minister P Chidambaram is hinting at a “massive” change in the country’s tax system, slashing tax rates on personal and corporate incomes in a second gamble on “the Laffer Curve”, which Chidambaram mentions by name as an idea he has embraced with enthusiasm” (Wanniski 2006).

Wanniski further writes: “The concept became the foundation for president Reagan’s supply-side tax cuts in 1981 and 1985 that brought top rates on personal income to 28% from 70% in 1980, and slowly but surely countries around the world are experimenting with it – the former communist countries of Russia and Eastern Europe, the People’s Republic of China, and most notably India and the other countries of the Asian subcontinent” (ibid).

In addition to the United States and India, tax reduction policy has been adopted throughout the world in the late eighties. ‘Of eighty-six countries with a personal income tax, fifty-five reduced their top marginal tax rate during the 1985-90 period, while only two (Luxembourg and Lebanon) increased their top rate. Countries that substantially reduced their top marginal tax rates include Australia, Brazil, France, Italy, Japan, New Zealand, Sweden, and the United Kingdom” (Gwartney 2006).

Critics of the supply-side notion disagree with the notion that tax cuts can lead to higher tax revenues. But the modern version of Ibn Khaldun’s theory, is far from discredited. Most of the economists recognize its potential validity, with empirical studies suggesting that tax revenues and tax rates begin to move inversely in the range of a 70 percent tax rate. Also, recent debates over tax rates have brought a greater awareness of how public policy can affect private economic incentives. In a world where national borders are becoming less important, governments must keep tax rates relatively low or face the loss of investment, jobs, and tax revenues to other countries.

16. Concluding remarks

As it is clear from the preceding pages, the thrust of this paper has been to investigate the relevance of Ibn Khaldun’s theory of taxation. Having been deeply involved in public life, his theory of taxation, therefore, reflects a pragmatic orientation. Dynamic as he was, he presented a dynamic theory of government expenditures and taxation. In the opinion of many scholars Ibn Khaldun’s theory of taxation is scientific in its own right and consequently it can be employed in a discursively meaningful way as a scientific component in economic theory. It is thoroughly realistic and empirical in nature and prescribes a perspective which is bound to reality and experience as verified by supply-side economists.

Lacoste (1984, p. 2) has rightly said: “Exploring the thought of Ibn Khaldun does not mean straying in medieval orientalism, plunging into the distant past of an exotic country or complacently entering into a seemingly academic debate. … It is, rather, a means of furthering an analysis of the underlying causes of the most serious of contemporary problems”. No doubt it has great relevance today in matter of taxation and governmental expenditure. “Only Ibn Khaldun is so close to our contemporary concerns, and his work is undoubtedly of much greater interest than that of any other early historian” (ibid. p.6). “The extraordinary thing about Ibn Khaldun is that he raised many of the questions that modern (social scientists) are asking and tried to answer them by analysing economic, social and political structures” (Ibid).

To Ibn Khaldun, a government budget may be surplus, balance, or deficit depending on the level of development and its composition of expenditure. Accordingly tax rates would be low, medium or excessive. It is the nature of government spending and its policy of taxation that determine whether it is passing through the period of formation, prosperity and stability, or depression and decay.

Ibn Khaldun pointed out various principles of taxation, such as equity and efficiency, justice and neutrality, ability to pay, economy, benefit and convenience, attributed to Adam Smith, Multiplier effect of government spending, incidence of taxation, in addition to a number of fundamental economic theories. In view of this, Boulakia (1971 p. 1117) was perfectly right to raise the question: “Should we retire the fatherhood of these economic concepts from the authors to whom they are attributed in our histories of thought?” Indeed, Ibn Khaldun was far ahead of his time in economic thinking. To Spengler (1964, p. 305), “had his [Ibn Khaldun’s] economic analysis not been so submerged in his more sociological analysis, it is possible that economic inquiry might have been carried forward effectively in the Muslim world, at least in the absence of oppressive governmental or ecclesiastical action.” In the opinion of this author, Ibn Khaldun was born in a declining phase of Muslim culture and intellectual atmosphere. He could not find among the successive generation a capable follower who could improve upon his ideas and develop them further. Otherwise, he would not have been so casually mentioned in the history of economic thought and analysis. It took six centuries for his ideas to resurface in economic discipline, though much to be desired.

Comments

Post a Comment